Concept of Dry Powder

Dry Powder refers to capital that has been committed to investment firms but hasn’t yet been deployed into deals.

In simple terms, it’s the pool of unallocated funds that private equity/ venture capital firms can use when the right opportunity arises.

For private equity firms, this dry powder represents the commitments made by their Limited Partners (LPs) that are still waiting to be invested. Having this reserve ensures that firms are always ready to seize strategic opportunities, whether it’s acquiring a promising business, scaling portfolio companies, or navigating uncertain market conditions.

On the flip side, dry Powder can actually weigh negatively on investors’ returns. Since IRR (Internal Rate of Return) is highly time sensitive, large pools of undeployed capital drag down performance the longer they sit idle. Add to that the pressure to deploy quickly, inflated entry valuations from too much money chasing too few deals, and the temptation to back mediocre opportunities just to “use the cash” – all of which erode investor returns. In short, excess dry powder may create flexibility, but for investors it often comes at the cost of IRR.

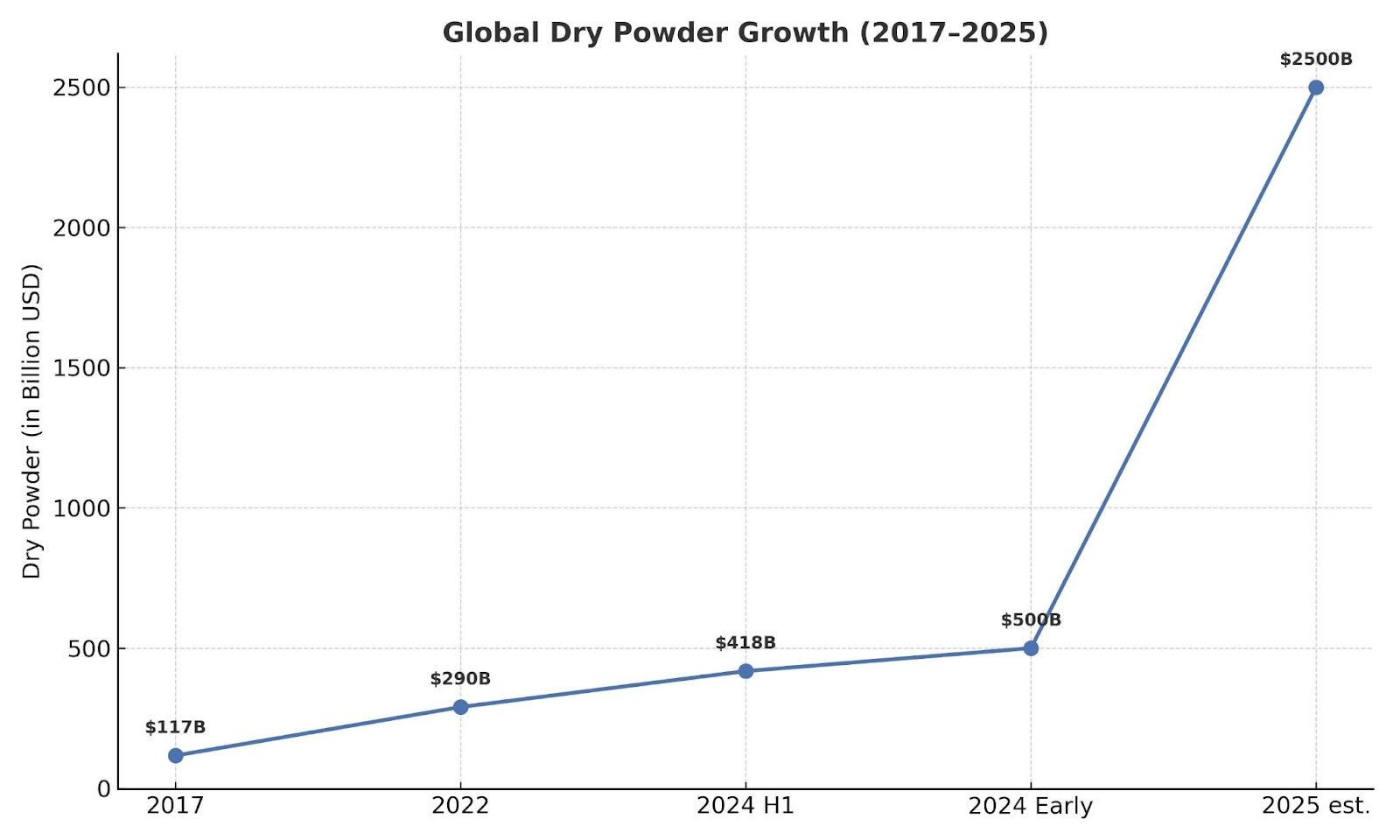

Global Private Equity Dry Powder in 2025: A $2.5 Trillion Waiting Game

Global private equity is sitting on a hefty $2.5 trillion “cash mountain” in 2025. But here’s the twist: nearly a quarter of that treasure has been gathering dust for four years or more.

- $2.5T Global Dry Powder (2025): Private equity sits on record reserves.

- Aging Capital: ~25% of buyout dry powder has remained undeployed for 4+ years.

- Double-Edged Sword: Provides firepower for big deals but drags on performance if idle too long.

- Deployment Pressure: Longer holding periods, delayed exits, and cautious dealmaking add liquidity risks.

- 2025 Outlook: PE holds both a cushion and a challenge – a massive war chest waiting to be strategically deployed.

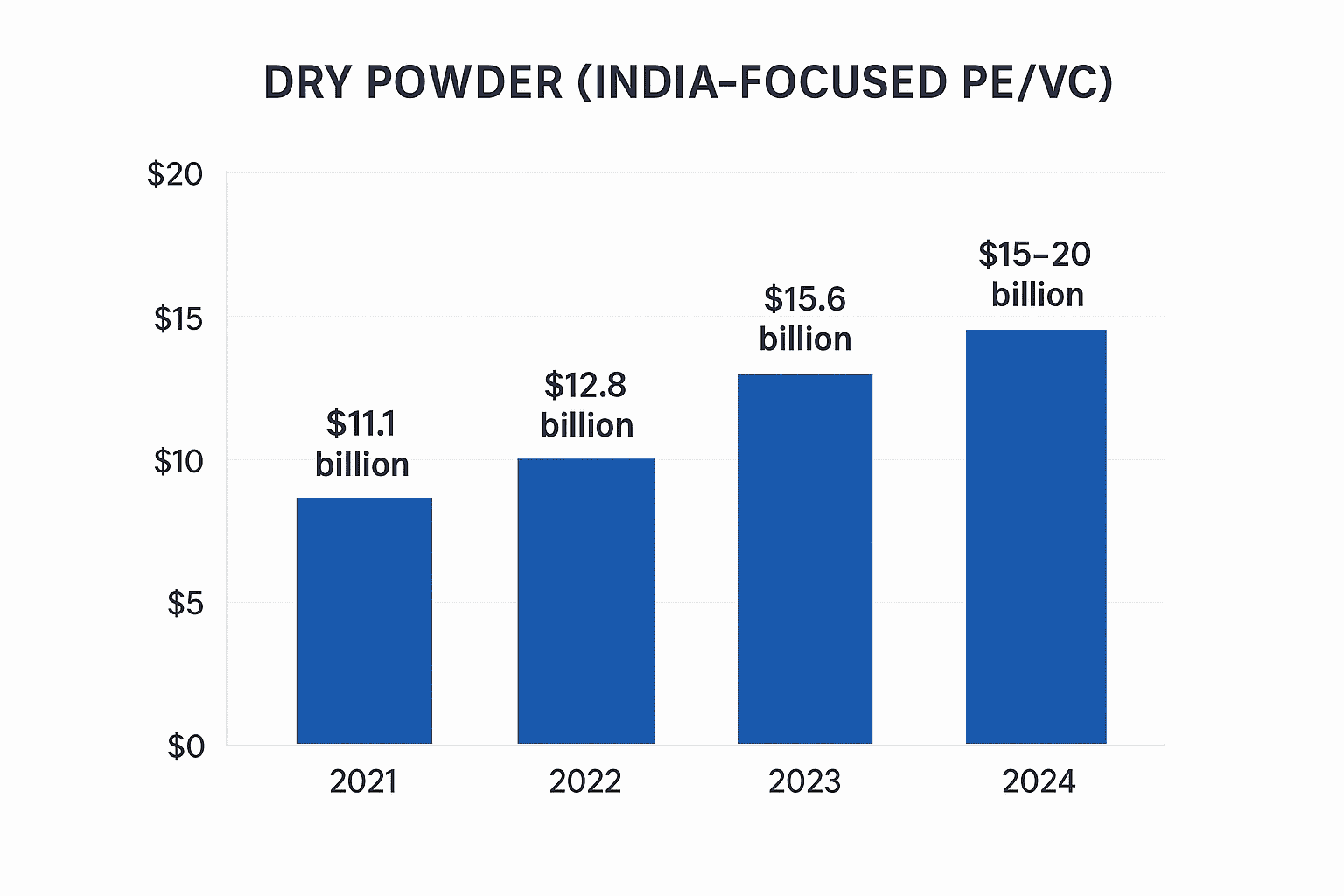

India’s $86 Billion Dry Powder: Fueling the Next Startup Wave in 2025

India’s startup and private equity ecosystem is entering 2025 with unprecedented momentum – backed by an estimated $86 billion in dry powder waiting to be deployed.

Key Highlights

- Funding Trends – In 2024, India raised $10.5B across 1,300 deals, slightly lower than 2023 due to cautious sentiment, but large $100M+ rounds are making a comeback.

- Fresh Capital Pools – Q1 2025 alone saw 23 new funds worth $3.2B launched, with a focus on fintech, AI, and SaaS.

- Shift in Investment Focus – Investors are favoring startups with clear profitability paths, especially in deep tech, financial services, and consumer tech.

How Investors Can Use Dry Powder in 2025

In 2025’s uncertain yet opportunity-rich market, “dry powder”- reserve capital held back for the right moment – has become a powerful advantage. When deployed wisely, it can turn volatility into opportunity and protect against downside risks.

Strategic Uses of Dry Powder

- Opportunistic Investments

Volatility creates undervalued deals. Investors with dry powder can move fast, securing attractive opportunities others miss. - Supporting Portfolio Companies

Reserves can strengthen existing holdings – funding growth, innovation, or bolt-on acquisitions to unlock value. - Growth Equity & Add-Ons

Beyond defense, dry powder fuels expansion through growth equity deals and strategic add-ons, building stronger platforms. - Diversification & Risk Management

Holding reserves allows reallocation across sectors, asset classes, and geographies – keeping portfolios resilient in shifting markets. - Liquidity & Flexibility

Maintaining cash ensures freedom to act without forced sales, enabling investors to wait for premium opportunities.

Takeaway : Dry powder is a tool for agility, resilience, and growth. By staying disciplined yet ready, investors can transform reserve capital into long-term outperformance.

The Startup Survival Tool in 2025 – And How iKomatch Helps You Build It

For startups, “dry powder” isn’t just a finance buzzword – it’s a survival tool. It means having a financial cushion – cash or easily accessible funds – that can be tapped into at the right moment. In today’s fast-moving business environment, this reserve capital can be the difference between missing an opportunity and scaling to the next level.

Where iKomatch Comes In:

While every founder understands the importance of reserves, not every startup has the network to access them. That’s where iKomatch steps in.

Our platform connects founders to 5,000+ verified investors – including venture capitalists, angel investors, and family offices – who together represent billions of dollars in deployable dry powder. Even if just 5-10% of global capital reserves are actively accessible through these investors, that translates into $4-8B+ in potential funding capacity for startups on our platform.

Instead of paying $600+ for static investor databases or relying on expensive investment bankers, iKomatch provides:

Curated Investor Access: Direct LinkedIn and email details of 5,000+ investors.

Smart Fundraising Support: Personalised outreach strategies to boost response rates.

Cost Efficiency: Skip hefty onboarding, transaction, and success fees – keep more capital as dry powder for your own growth.

Conclusion

Dry powder isn’t just cash on the sidelines – it’s the secret weapon for turning market chaos into opportunity. In 2025, the smart money won’t be the fastest spenders, but the most disciplined investors who know when to strike. Hold steady, act sharp, and let dry powder fuel the wins that matter.